“Is this the new normal?” It’s the question cities around the country are asking — and the stakes are high. If the monumental changes we see in work and travel behavior due to COVID have reached a new equilibrium, “the new normal” is different enough from pre-COVID behavior to have a significant impact on the health and vibrancy of the places we live.

The jury is still out. Conventional wisdom suggests work from home is both here to stay and on its way out, that both the downtown core is dead and ready to be reinvented.

Of course, we can’t know for sure who’s right (and the answer is probably not the same for each metro across the country). However, in conjunction with the release of Replica’s new Spring 2023 data, we’re highlighting four observations we’re seeing today as compared to pre-pandemic and thinking through the implications if this really does become the new normal:

1. Transit is in trouble.

Nationwide, public transit ridership is down more than 40% since 2019. Ridership is down double-digits in every top metro area in the United States (except for Miami, which is only down 4%). And ridership is less than half of its pre-COVID levels in four cities — Washington, DC, Chicago, Columbus, and Detroit.

Fewer riders means lower fare revenues, which leads to budget cuts and reduced service, which in turn means the system can serve fewer riders. That cycle is the oft-discussed “death spiral” from which cities fear it is impossible to recover.

This has long-term implications for congestion, land use allocation, and economic development. Moreover, it raises equity concerns as these transit systems become more crucial to minority and lower-income residents. For instance, non-white residents now make up 61% of transit ridership in Los Angeles (up from 50% pre-pandemic) and 54% in Miami (up from 43% pre-pandemic).

2. Downtowns aren’t back. But the worst may be over (for some).

In the downtown cores across the 20 metros we studied, not one saw an increase in restaurant spending between Fall 2019 and Fall 2022 (even without adjusting for inflation). And only four of the twenty saw an increase in retail spending across the same time period.

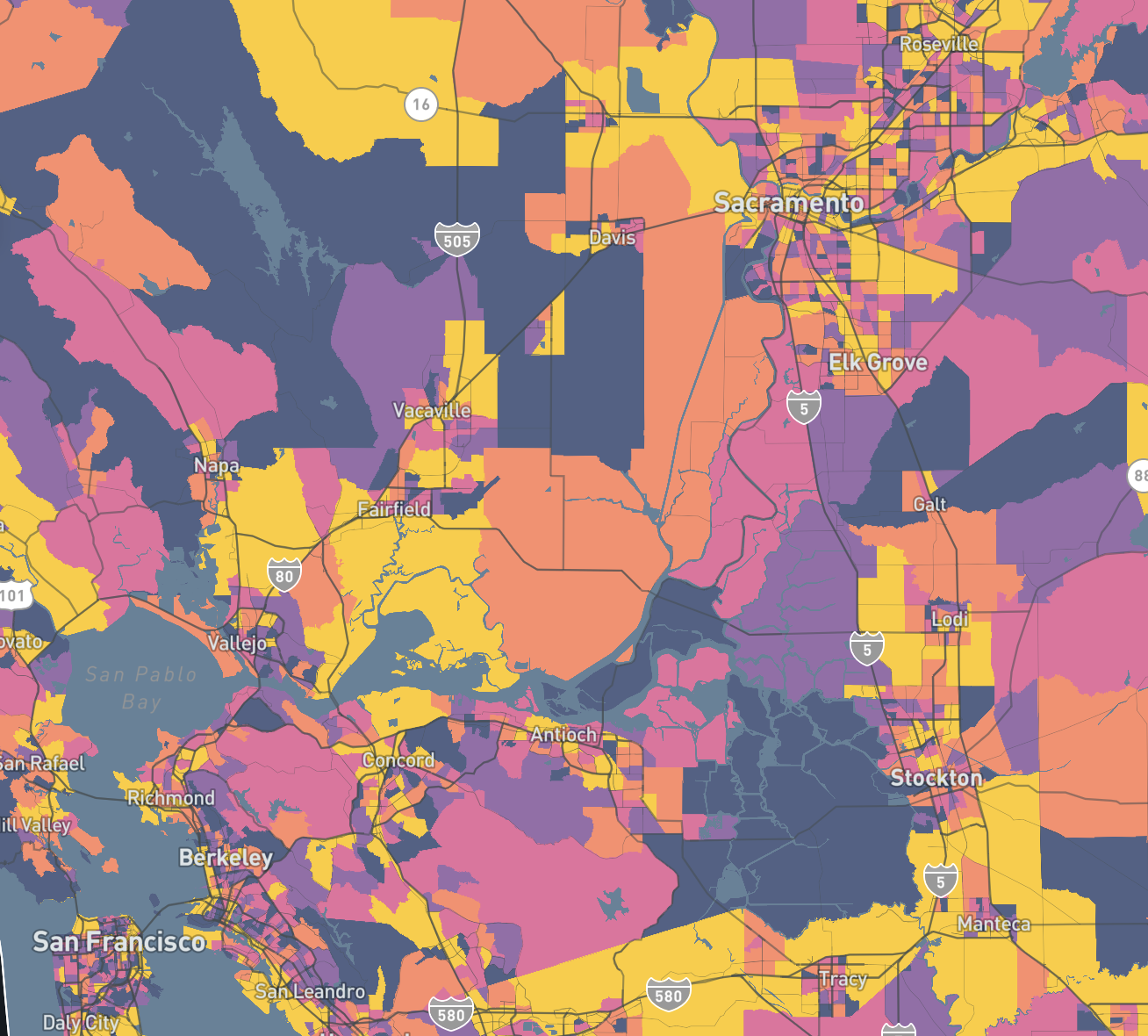

On the positive side, this may reflect a redistribution of consumer spending, as more flexible work schedules allow residents to eat and shop closer to where they live than where they used to commute to work every day. This new pattern may help spur more sustainable, mixed-use neighborhoods in more parts of major metros.

But it also creates new challenges. Take New York, where retail employment is still down 11% since pre-COVID, even as the remainder of private sector employment has effectively returned to pre-COVID levels. As the New York Times notes, service jobs are a particularly critical employment sector for inclusive economic development, as these jobs are held disproportionately by younger, diverse residents without a college degree. The good news is that signs of improvement are emerging. Of the 20 metros we studied, nine (45%) saw an increase in downtown restaurant spending between Fall 2022 and Spring 2023, and another 3 stopped the bleeding and were essentially flat.

3. A universal increase in vehicle miles traveled (VMT).

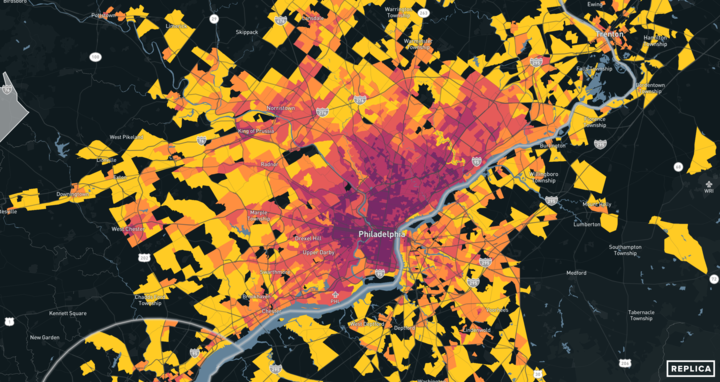

We see a consistent increase in both total private auto trips and vehicle miles traveled nationwide between Fall 2019 and Spring 2023, ranging from just a slight increase in places like New York (up 2.6%) and Philadelphia (up 3.5%) to large increases in LA (up 9.1%) and Atlanta (up 16.5%).1

While at first, this may seem counterintuitive to the significant increase in working from home, the data reveals two trends. First, there is a notable shift from public transit to private auto trips for those who still do commute to work, and these trips are generally longer than average. Recapturing these trips is a vital challenge for transit agencies aiming to remain solvent.

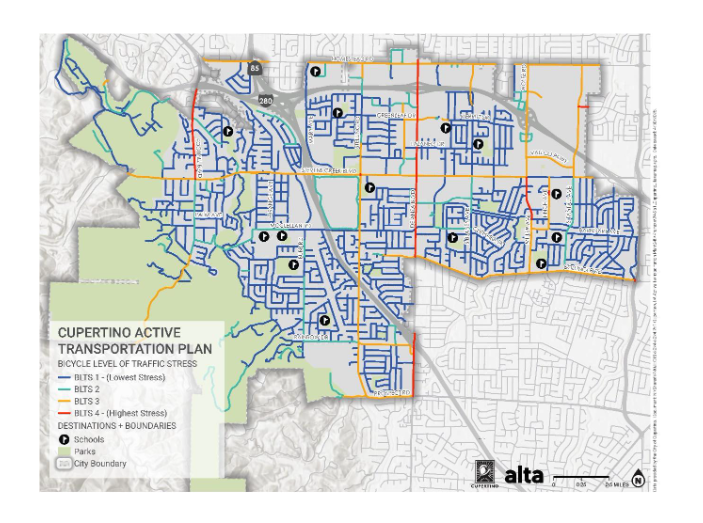

Second, the freedom of flexible work schedules and increased work-from-home gives those workers the ability to make many more short trips, whether for a quick break from work in the early afternoon or because going to their preferred grocery store, which wasn’t on their usual commute, is now more convenient. It’s hard to compete with the convenience of personal cars, but these trips are prime targets for communities that can add enough density to make walking and biking viable options in a mixed-use “15-minute neighborhood.”

4. Cities are losing their circadian rhythm.

All of the above point to a shift away from the patterns that have defined our cities since the middle of the 20th century. The 9 to 5 commute – what E.B. White said gives cities their “tidal restlessness” — just isn’t the same driving pattern it once was. In the metros we looked at, work-from-home behavior shows a sustained 400-500% increase from pre-pandemic to today. This shift, from roughly 3-6% of the workforce working from home on a given day in 2019 to approximately 18-30%, is massive.

Much of transportation planning has traditionally been centered on managing peak travel demand. In this new normal (if it really is), we may all have to rethink our assumptions of how we accurately model movement in our cities, what peak speeds and flows we optimize for, and how we best serve a population with more diverse travel patterns.

Log in to your Replica account today to start an analysis using Spring 2023 data. Not yet a customer? Get in touch here to schedule a demo.

1 An earlier version of this post cited incorrect figures for changes in VMT due to the way commercial freight travel was calculated. These figures have been updated to include all motor vehicles.